Getting evicted from your home can be an extremely traumatic experience caused by financial distress. Luckily, the fact that you were evicted doesn’t show up on your credit report.

However, there are some eviction-related financial issues that can negatively affect your credit score, make it tougher to qualify for credit and even affect your ability to find somewhere else to live.

What Happens During an Eviction?

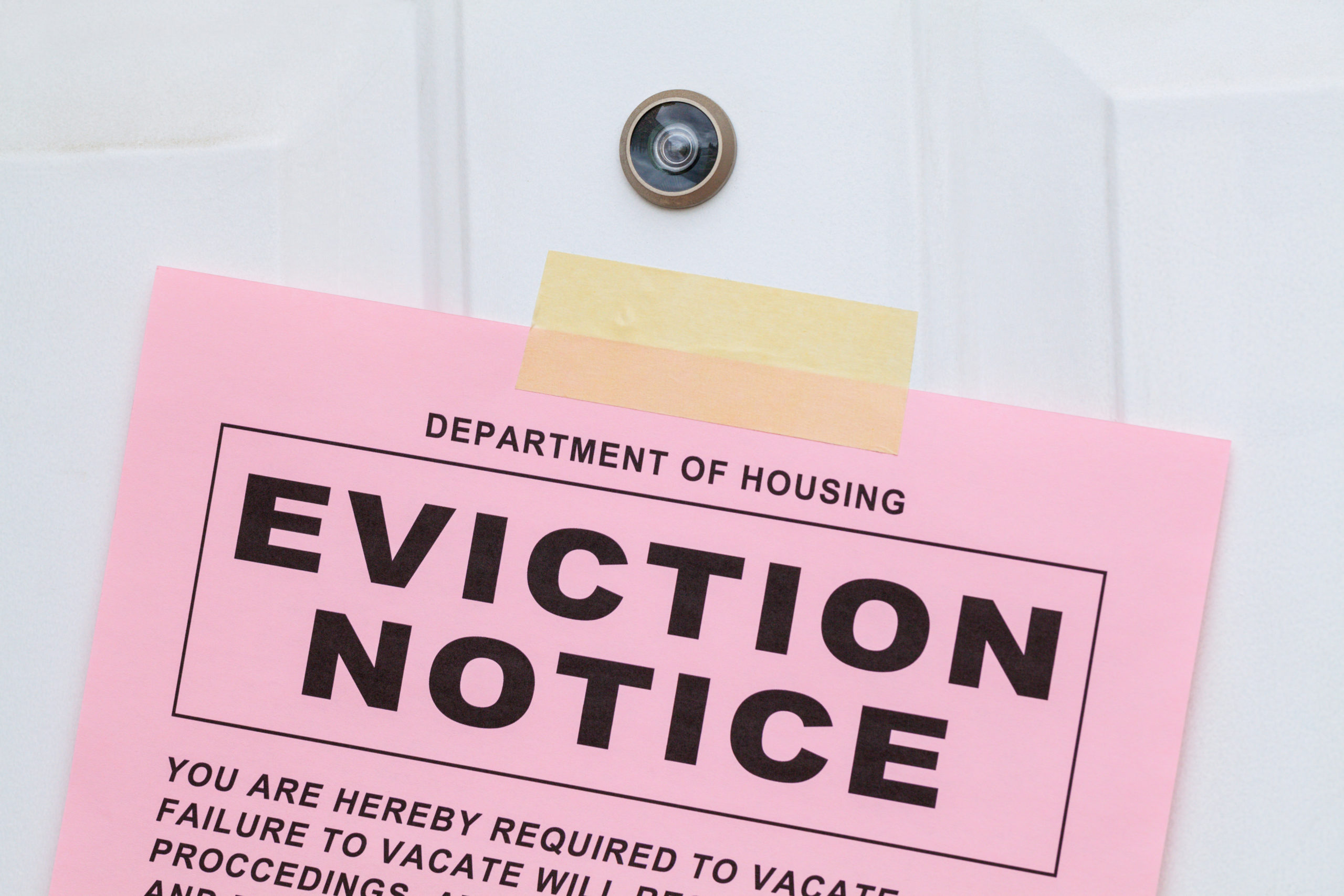

When your landlord moves to evict you from your rental home, you receive an eviction notice that says you are in violation of the lease agreement. Eviction notices can be curable, which means you can stay in the home by fixing a certain issue like paying rent that’s past due. Or, they can be incurable, which means you are required to vacate your home by a certain date.

Reasons you may receive an eviction notice include failing to pay your rent, staying in your home past the terms of the lease, causing property damage beyond normal wear and tear and otherwise violating terms of the lease agreement. You also may be evicted if the property manager is selling the home you reside in.

Eviction laws can differ between states, counties and even towns or cities. Depending on where you live, you may need to vacate the property within a predetermined amount of time as outlined in the eviction notice. In many cases, if you don’t respond to the notice (either by fixing the issues in a curable notice or by moving out), the landlord may go to court and get a judgment that allows law enforcement to require you to vacate the property.

Usually, you have the option to appear in court to fight the eviction.

How Does Getting Evicted Affect Your Credit?

Evictions won’t show up on your credit report. But there are ways that eviction-related issues can impact your credit, directly or indirectly:

- When you fail to pay your rent on time, the landlord may report the late payment to the credit bureaus after 30 days. Not all landlords report late rent payments, but some do. Payment history is the single most important factor in determining your credit score, and one late payment can do a lot of damage, especially if you previously had excellent credit.

- Accounts in collections show up on your credit report and can lower your credit score. If the landlord sells your debt to a collection agency, that information can negatively impact your credit.

- If the landlord sues you for unpaid debts and wins a court judgment against you, that judgment becomes a matter of public record. While it won’t show up on your credit report, lenders and landlords have the ability to search for that information. In this way, court judgments could affect your ability to qualify for credit and even rent homes in the future.

- If you amassed a lot of credit card debt to stay afloat as you tried to make your rent payments, you may have increased your credit utilization ratio to a level that negatively impacts your credit.

- Taking on too much debt, including credit cards and personal loans, can negatively affect your credit if it ends up becoming unmanageable.

- Getting evicted can create a domino effect that leads to other financial problems, like failing to pay other bills on time. These issues can snowball into multiple credit problems.

- In some cases, declaring bankruptcy can help you stop or delay eviction proceedings and stay in your home, at least temporarily (depending on where you are in the eviction process). It can also help you wipe the slate clean on existing debts or work out a repayment plan with your creditors. But, bankruptcy can negatively affect your credit and affect your credit score for seven to 10 years, depending on the bankruptcy type.

Having eviction-related credit issues can make it more difficult to get approved for credit, and the credit you do qualify for will have less favorable terms. You may even have trouble qualifying for certain jobs or renting certain homes, as some employers and landlords run credit checks or tenant screening checks. Eviction court judgments are also a matter of public record and available to anyone who takes the time to look.

How to Minimize Damage to Your Credit

The best way to keep an eviction from negatively impacting your credit is to avoid getting an eviction notice in the first place. Make sure you understand the terms of your lease agreement and what is expected from you as a tenant. If you’re having trouble making rent payments, the landlord may be willing to work with you instead of going through the process of eviction, which can be time consuming and expensive. But you’ll need to let your landlord know before you start missing rent payments.

Do what you can to settle unpaid debts before they get reported to the credit bureaus. You may be able to stay in your home and avoid damage to your credit score if you pay up ASAP (or work out a payment agreement with the landlord). Or you can pay your debt and mutually agree to end the lease early to avoid eviction proceedings.

If you’re past the point of negotiations, moving out voluntarily can help you avoid an eviction judgment or civil judgment against you. Losing a civil suit for unpaid rent can result in your wages getting garnished and make it harder for you to rent again.

If your debt is sent to collections, you may be able to negotiate and settle the debt for less than the original amount owed. Once it’s paid, the debt can show up with a $0 balance on your credit report and some of the newer credit scoring models won’t factor it into your credit score. The debt can remain on your credit report until seven years from when it was first reported.

Consider signing up for a credit monitoring service to receive regular copies of your credit report and get notified when new information is added to your credit file. Whether you’ve had to move out or you’ve stayed in your home, it’s important to ensure that the information in your credit report is fair and accurate.