Be Prepared. Know Your FICO® Scores.

Complete Credit & Identity Protection

Be confident by knowing your FICO® Scores – the scores used by 90% of top lenders.1

CUSTOMER TESTIMONIALS

Don't Just Take Our Word for It...

Jessica S.

✓ Verified Customer

“The dollar trial was great. I got to see my scores and reports from all 3 bureaus for just a buck. It showed a detailed credit report with creditor names and contact numbers. It also shows public records and previous employers.”

Denise L.

✓ Verified Customer

“I really like using MyScoreIQ. My membership gives me my monthly FICO® Score, which has been a great tool to use since I'm in the market to buy a house. I also love the identity protection they offer. I signed up for a Charles Schwab account and got an alert within minutes! I definitely recommend this service to anyone who wants to stay on top of their credit!”

Kari H.

✓ Verified Customer

“What I love about MyScoreIQ credit monitoring is that I can check my FICO® Scores each month. This really helped me when I went in to get an auto loan for a new vehicle when my family outgrew our old one. I knew my FICO® Scores, and I knew I’d get the best rate.”

Actual customer testimonials. Photos are illustrative only.

PLANS & PRICING

Choose Your Plan. Get Protected Instantly!

IdentityIQ credit report and identity theft monitoring provide you with peace of mind and a variety of plans that allow you to choose what best fits your needs.

Billed Monthly

Billed Annually

WHAT WE DO FOR YOU

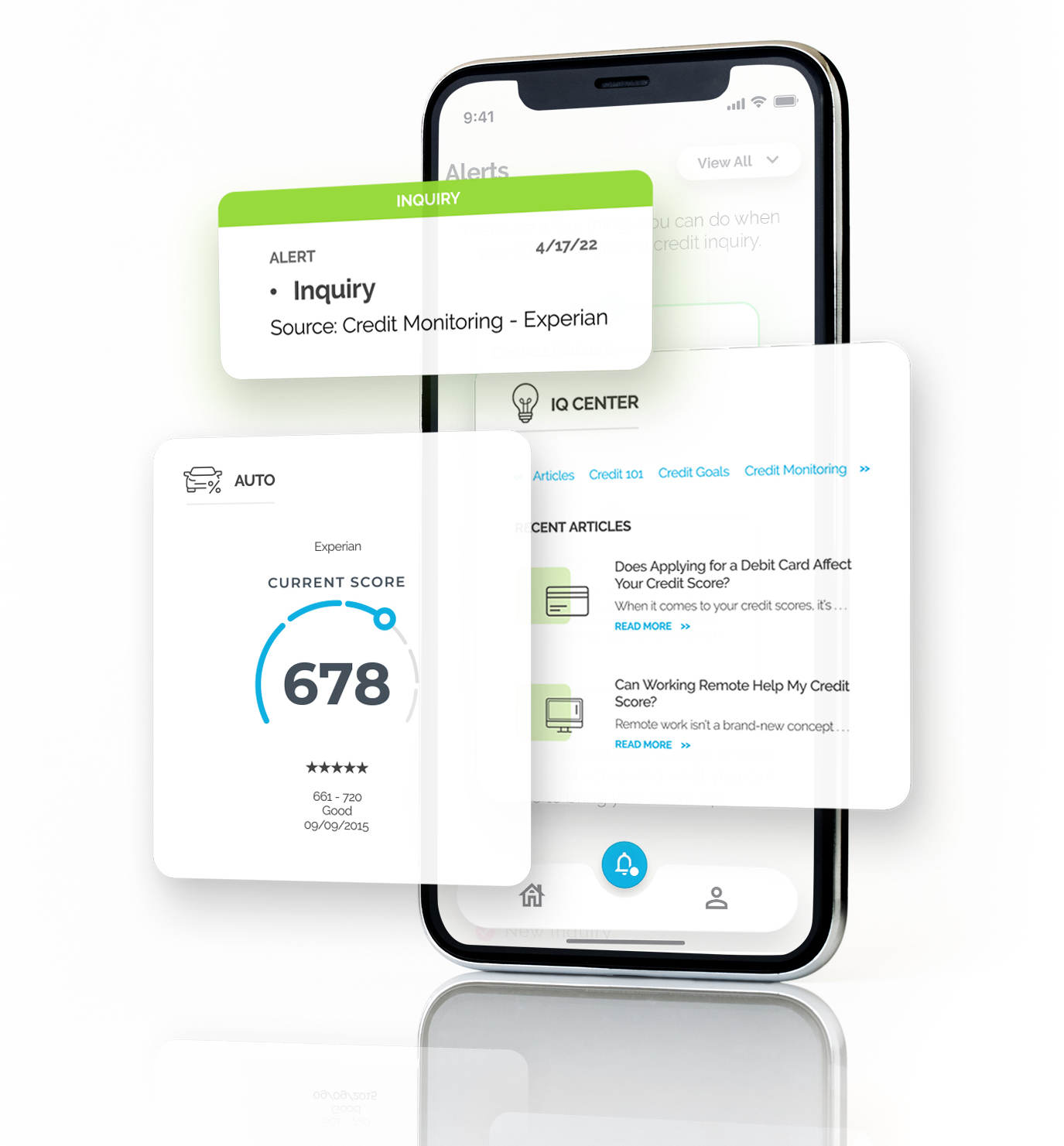

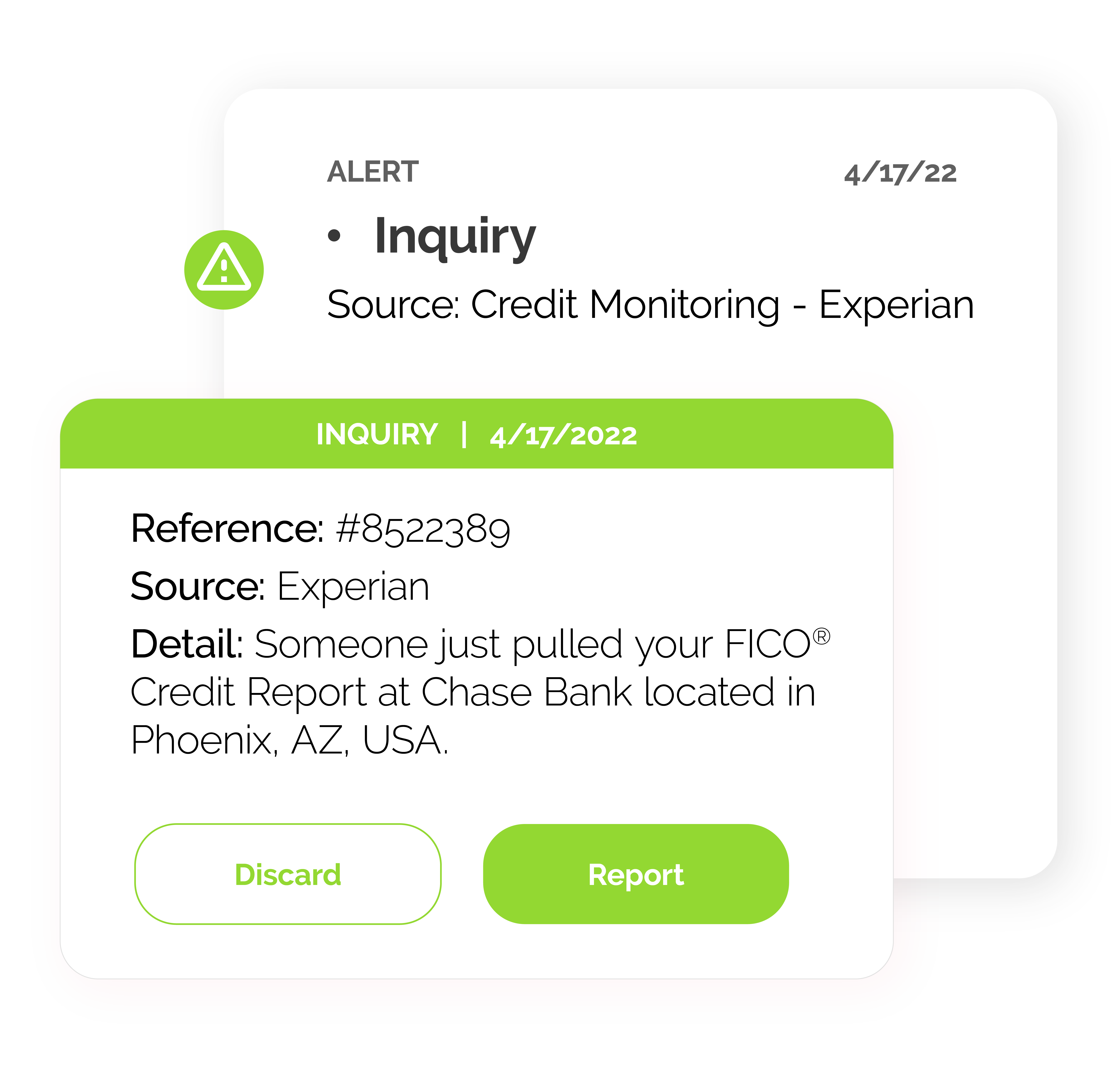

Real-Time Credit Monitoring

Active credit monitoring allows you to stay on top of your FICO® Scores. You also receive monitoring alerts for suspicious activity such as new credit inquiries, new loans and delinquent accounts that are reported in your name.

WHAT WE DO FOR YOU

Intelligent Identity Theft Protection

Along with credit report monitoring and FICO® Scores, you receive the added value of identity theft protection. This includes monitoring of your personal information, such as your name and Social Security number, on the internet and dark web for suspicious activity, change-of-address monitoring and more.

KEY STATISTICS

How Bad Credit Can Affect You

It can raise the price of your bills

Cellphone providers, insurers, and even utility companies may worry about your score and charge you fees or higher rates.

It can keep you from getting what you want

Your credit score is a huge factor in determining loan approvals for things like cars and homes.

It could keep you from getting hired

47% of employers run credit checks on job candidates primarily to reduce liability for negligent hiring, and assess trustworthiness.2

Source: Business Insider

OUR FEATURES

Everything You Need to Take Control of Your Credit & Identity

3-Bureau FICO® Scores & Reports

Get your complete credit outlook from the 3 major credit bureaus, insights into your report profile, and 100% U.S.-based customer service support.

$1 Million ID Theft Insurance

Get up to $1 million in stolen funds reimbursement, coverage for lawyers and experts, and coverage for personal expense compensation.3

FICO® Score Simulator

Get our easy-to-use online simulator tool, view current scores and potential changes depending on possible payment events or other actions, and assistance in planning for your financial future.

Fraud Restoration

Get access to our 100% U.S.-based identity restoration experts who can help assist you and bring you peace of mind.

.png)